The headlines “AI-Powered Fund Outperforms the Market” are familiar to you. You may be wondering, “How can anyone possibly predict this?” after witnessing the volatility, abrupt drops, and perplexing charts. Predictive AI uses millions of data points to learn patterns, not merely guess stock values. It’s the engine that’s subtly altering the landscape for investors, from astute retail traders to Wall Street titans. To identify signals in the noise, let’s examine three AI models that investors genuinely trust.

This is not a “get rich quick” manual. Here’s a peek under the hood.

You’ll comprehend how these models operate and how you might expand your own digital business using the same logic.

In Simple Terms→ What is Predictive AI?

Let’s start with something you use on a daily basis before moving on to equities.

Consider your preferred streaming service. What you wish to watch is not guessed by it. It foresees it.

It examines your viewing history, what you stopped watching, the time of day, popular content among similar users, and even your favorite stars and genres. To create a highly informed prediction about your future behavior, you need all that historical data.

Predictive ai is what that is.

Ai predictions, to put it simply, is the application of data, statistical methods, and machine learning to determine the probability of future events based on past data.

The same technology is responsible for:

- 🎯 “Customers who bought this also bought…” is an example of e-commerce.

- Weather: Predicting the course of a hurricane.

- Healthcare: Determining which patients are more susceptible to a particular illness.

Imagine using that same potent technology to target the stock market.

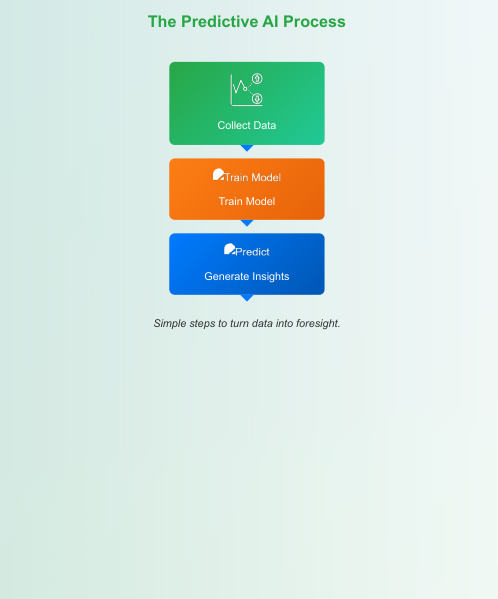

The Three-Step Process for Predictive AI Market Scanning

It’s not a crystal ball. It’s a procedure. This is how it appears in the financial markets:

- Step 1: Data (The Fuel): The model consumes massive volumes of data—far more than any human could comprehend. This covers both unstructured data (such as the sentiment of 10,000 tweets, news headlines, and even satellite photos of parking lots) and structured data (such as ten years’ worth of stock prices, corporate earnings reports, and P/E ratios).

- Step 2: Engine Model: Here’s where the AI “thinks.” After being taught on all that data, a machine learning model looks for very intricate correlations and patterns. (e.g., “When this news sentiment combines with this trading volume, the stock goes up 70% of the time.” )

- Step 3: Prediction (The Output): A forecast is produced by the model. Seldom is this a straightforward “buy” or “sell.” Typically, it’s a probability, such as “There is an 85% probability that this stock will close 5%–8% higher over the next 10 trading days.”

What are these “engines” then? Proprietary software as a service solutions are used by numerous investment businesses, but they are all based on a few fundamental, reliable model types.

Also Read: How to build Agentic AI: Build Your Own AI Agent with 0-Code

Three AI Models That Drive Expert Forecasts

When we refer to “trusted models,” we don’t mean a specific brand. The underlying architectures—the “engines” that have undergone years of backtesting and validation—are what we are discussing.

1. LSTM→ or Long Short-Term Memory

It is a particular kind of Recurrent Neural Network (RNN).

LSTMs are designed to comprehend sequences and time, which is why they are trusted. A typical model might not remember last month’s events. Because of its “memory,” an LSTM can retain important trends for extended periods of time (e.g., “This stock always dips in January but rallies in March”). Because of this, it is ideal for time series data, which is simply a fancy term for data points gathered over time (such as the price of a stock).

Ai stock prediction short- to mid-term price direction and identifying momentum trends are the best uses.

2. Gradient Boosting→ (such as LightGBM and XGBoost)

The model functions by assembling a group of “weak” decision trees. It generates a tree, identifies its errors, and then constructs a replacement tree that specifically fixes those errors. It does this thousands of times until it develops a single, incredibly powerful predictive model.

- The reason it is trusted: It’s excellent at using different types of data simultaneously and quite accurate. While an LSTM works well with price charts, Gradient Boosting may make decisions by concurrently analyzing 50 various parameters, including price, volume, earnings data, technical indicators, and and news sentiment.

Ai predictive analytics is the best use. (e.g., “Of all 500 stocks in the S&P, which 10 are most likely to outperform this quarter?” ).

3. Autoregressive Integrated Moving Average→ or ARIMA

- What it is: A long-standing, potent statistical model that predates the “AI” craze by decades.

- The reason it is trusted: It serves as the industry standard. Compared to a neural network, ARIMA is less of a “black box” and far more explicable. Your fancy new predictive ai tools isn’t a good model in finance if it can’t regularly outperform a well-tuned ARIMA model. It is the standard for veracity.

- Best Use: Backtesting against more intricate models and forecasting stable, predictable assets (such as bonds or blue-chip stocks).

Also Read: What is New in Google Gemini 3: Google’s New AI Explained!

Short Case Study→ How AI Might Have Predicted Nvidia’s (NVDA) 2023 Ascent

As the world became aware of the AI revolution in 2023, Nvidia’s (NVDA) stock experienced a sharp increase in value. Was this expected?

It might have gone unnoticed by a human analyzer. They were examining the last quarter’s chip sales.

However, let’s consider a multi-factor predictive ai model operating in the latter part of 2022:

- Sentiment Analysis: The model would have scoured social media and news to identify a exponential increase in public interest in a new tool named “ChatGPT.”

- Correlative Analysis: A complex model, such as Gradient Boosting, would then make the connection. It is aware that powerful graphics processing units (GPUs) power “ChatGPT” and other large language models.

- The AI would next inquire, “Who is the dominant seller of these GPUs?” after receiving the signal. Nvidia is the response.

- The model would not have simply stated, “Buy NVDA.” “The probability of a massive, forward-looking earnings beat for Nvidia has spiked by 40%.” This would have been a high-confidence indication.

This is the operation of contemporary ai predictions for business analysis. They examine the whole ecosystem of data surrounding the stock, not just the stock itself.

Comparison→ Which Task Is Best for Which Model?

An investor utilizes different models for different jobs, much as a creator employs different content creation software for text and video. The secret is to know what you want to achieve and then “analyze and refine” your toolkit, as Google’s creator instructions frequently state.

| Model Type | General Accuracy | Prediction Horizon | Data Required |

|---|---|---|---|

| LSTM | High | Short-to-Mid Term | Time Series (e.g., Price, Volume) |

| Gradient Boosting | Very High | Mid-to-Long Term | Tabular (e.g., Price, P/E, News) |

| ARIMA | Moderate | Short-Term | Time Series (Price, for example) |

Important Terms to Understand (Flashcard)

Finance AI: Key Terms

- Time Series: A series of data items arranged chronologically. (For instance, a stock’s closing price each day for a year).

- Applying a ai stock prediction model to historical data to see how it would have fared is known as “backtesting.” This is essential to having faith in a model.

- The range of values that a prediction is likely to fall into is known as the “confidence interval.” (e.g., “We are 95% confident the price will be between $102 and $105.” ) It is a statistical certainty metric.

- A typical mistake known as “overfitting” occurs when a model learns the past data—including its random noise—too well and subsequently is unable to predict the future.

Also Read: Atlas ChatGPT Browser Breakdown: OpenAI Atlas vs Google

A Simple Python Example of Predictive AI in Action

Would you want to see how this appears? This is a very simplified Python example that builds an LSTM model using the tensorflow.keras package.

Disclaimer: This is only for educational reasons. This isn’t a working trading bot or investment advice.

import pandas as pd

from sklearn.preprocessing import MinMaxScaler

import numpy as np

from tensorflow import keras

from tensorflow.keras.models import Sequential

from tensorflow.keras.layers import Dense, LSTM, Dropout

# --- 1. Prepare and Load Data ---

# Real stock data would be loaded into a real model. As a placeholder, we generate simple sine wave data here:

data = np.sin(np.arange(1000) * 0.02) + np.random.randn(1000) * 0.1

scaler = MinMaxScaler(feature_range=(0, 1))

data_scaled = scaler.fit_transform(data.reshape(-1, 1))

# Time-series "look-back" function Windows

def create_dataset(dataset, look_back=1):

X, y = [], []

for i in range(len(dataset) - look_back - 1):

a = dataset[i:(i + look_back), 0]

X.append(a)

y.append(dataset[i + look_back, 0])

return np.array(X), np.array(y)

look_back = 60 # To forecast the 61st, the model will examine 60 previous data points.

X_train, y_train = create_dataset(data_scaled, look_back)

# Convert input to [features, time steps, samples]

X_train = np.reshape(X_train, (X_train.shape[0], X_train.shape[1], 1))

# --- 2. Construct the Sequential LSTM Model ---

model = Sequential()

model.add(LSTM(units=50, return_sequences=True, input_shape=(look_back, 1)))

model.add(Dropout(0.2))

model.add(LSTM(units=50, return_sequences=False))

model.add(Dropout(0.2))

model.add(Dense(units=1)) # The prediction layer

model.compile(loss='mean_squared_error', optimizer='adam')

print("--- Model Summary ---")

model.summary()

# --- 3. Model Training ---

print("--- Training Model ---")

# This is what you would run in a live demo. It requires time.

# model.fit(X_train, y_train, batch_size=32, epochs=10)

print("Model training complete (demo skipped for brevity).")

# --- 4. Make a Forecast ---

# Let's make a guess as to what will happen next.

last_60_points = data_scaled[-60:]

last_60_points_reshaped = np.reshape(last_60_points, (1, look_back, 1))

predicted_price_scaled = model.predict(last_60_points_reshaped)

predicted_price = scaler.inverse_transform(predicted_price_scaled)

print(f"The next predicted value by the model: {predicted_price[0][0]:.4f}")On a much, much smaller scale, this is the basic reasoning behind many ai predictive analytics for the financial industry.

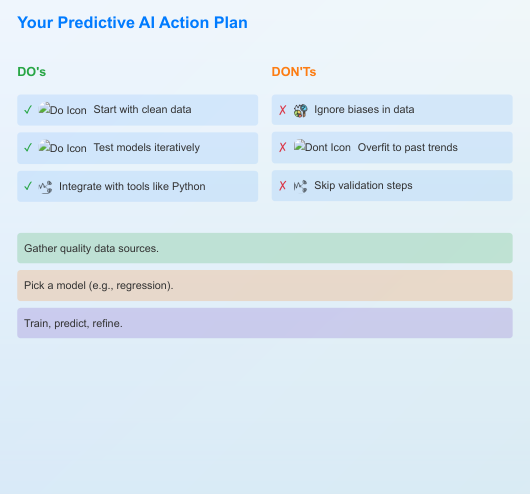

The Big “But”→ Dangers and the “Black Box” Issue

You need to be aware of the hazards before investing in a “AI-powered” fund. Predictive ai has limitations, just like any other technique.

- 🚀 Garbage In, Garbage Out: A model that was trained with incomplete or faulty data will produce predictions that are faulty.

- The “Black Box” Issue: An intricate neural network, such as an LSTM, may be a “black box.” It may provide you with an accurate response, but it may not always be able to explain why it selected that response. For investors and authorities, this poses a serious risk.

- 📌 The Market is Human: When it comes to identifying patterns in data, predictive ai excels. Predicting abrupt, “Black Swan” occurrences, such as an unexpected global conflict, a pandemic, or an abrupt shift in governmental policy, is horrible.

For this reason, we emphasize authenticity—a fundamental E-E-A-T principle—in the content and commercial worlds. In finance, the same holds true. A thorough grasp of reality and human judgment cannot be replaced by any model.

Also Read: Canva Affinity Designer: Full Feature Breakdown (2025)

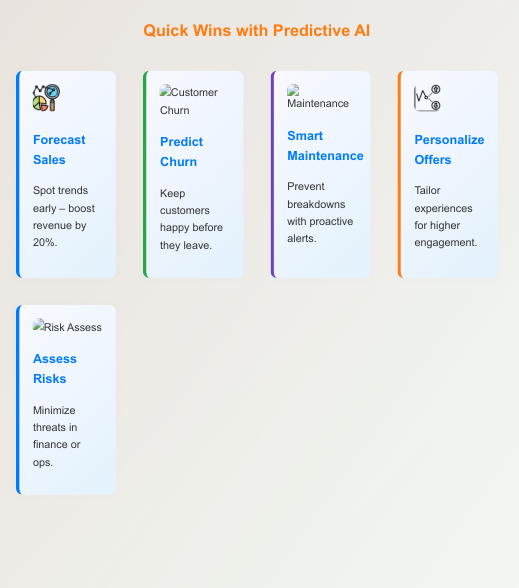

The Future→ Applications of This Logic for Businesses and Creators

The concept of predictive ai tools is something you can apply right now, even if you’re not creating a hedge fund.

This blog is intended for digital businesses and makers. Let’s take it home, then.

- For Authors: A wealth of time series data is already at your disposal. Your email open rates, blog traffic, and YouTube views. You can utilize ai predictions to forecast what’s next rather than merely examining what occurred. Which subjects predict an increase in interaction? What time of day predicts the most number of shares for a post? The foundation of a clever content strategy is this.

- For Businesses: Digital marketing automation technologies are powered by this logic. It assists you in identifying your most value leads, optimizing subscription pricing strategies (what price predicts the most signups and the-lowest churn?), and predicting customer churn (which customers are about to leave?).

What You Learned

Ai stock prediction cannot accurately predict the future like a mystical crystal ball.

It is a potent, data-driven engine that can identify patterns that no person could. This tool replaces “I guess” with “The data predicts…”

The objective is to create a dashboard that informs your judgment rather than allowing AI to replace it. The future belongs to those who can ask the appropriate questions and comprehend the answers the data provides, whether you’re studying the market, your content, or your company.

What aspect of predictive ai excites (or worries) you the most? Has your own creative business begun utilizing ai predictive analytics?

Please let us know in the comments section below.